Investment Growth Indicators for 582671638, 25600112, 2130392750, 911177566, 4808416993, 726399242

Investment growth indicators for assets 582671638, 25600112, 2130392750, 911177566, 4808416993, and 726399242 present a complex landscape of performance metrics. Historical analysis reveals distinct trends and patterns. Market dynamics have shifted significantly, influencing risk assessments across these assets. Understanding these factors is crucial for identifying future growth opportunities. The following sections will explore these elements in greater detail, shedding light on potential strategies for investors.

Historical Performance Analysis

Analyzing historical performance provides critical insights into investment growth trends. By examining historical returns, investors can discern patterns that inform future decisions.

Performance benchmarks serve as essential tools for comparison, allowing investors to measure their portfolios against market standards. This analytical approach fosters a deeper understanding of investment dynamics, empowering individuals to pursue financial independence while navigating the complexities of the investment landscape.

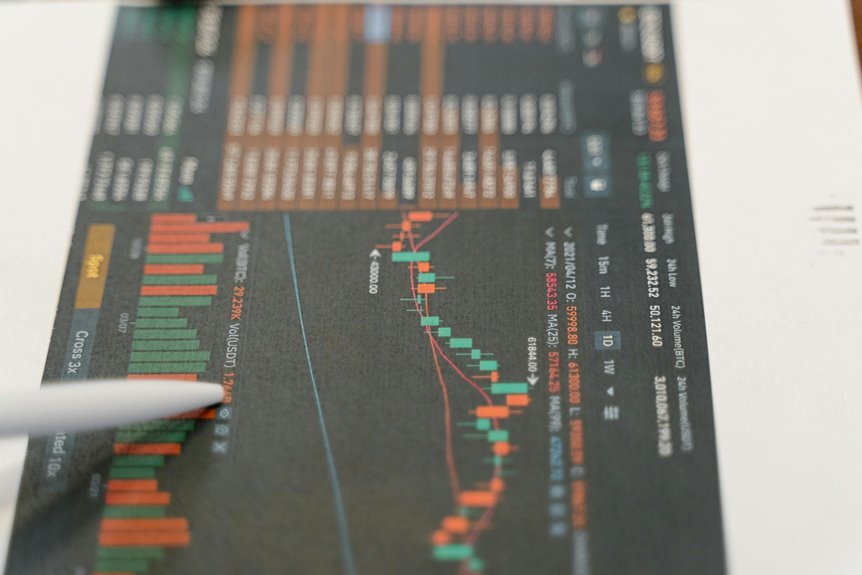

Market Trends and Indicators

While various factors influence the investment landscape, market trends and indicators play a pivotal role in shaping investor behavior and decision-making.

Market volatility serves as a barometer for risk, guiding strategies during different economic cycles.

Investors who analyze these trends can better anticipate shifts, making informed choices that align with their desire for financial freedom and stability amidst the uncertainties of the market.

Risk Assessment Metrics

Risk assessment metrics serve as essential tools for investors seeking to quantify potential losses and evaluate the likelihood of adverse outcomes in their portfolios.

By analyzing risk tolerance and conducting volatility assessments, investors can strategically align their investment choices with their comfort levels regarding risk.

This approach enables a more informed decision-making process, ultimately leading to a more resilient and adaptable investment strategy.

Future Growth Projections

Future growth projections are critical for investors aiming to identify potential opportunities and align their strategies with market trends.

Analyzing various sectors reveals future potential driven by growth catalysts such as technological advancements, demographic shifts, and sustainability initiatives.

Investors who understand these dynamics can better position themselves to capitalize on emerging trends, ensuring their portfolios remain resilient and adaptive in a changing economic landscape.

Conclusion

In conclusion, the investment growth indicators for assets 582671638, 25600112, 2130392750, 911177566, 4808416993, and 726399242 reveal a tapestry of opportunities and challenges. By scrutinizing historical performance, current market trends, and rigorous risk assessments, investors can navigate the shifting sands of the economic landscape. As the future unfolds, a keen understanding of sector dynamics will act as a compass, guiding strategic decisions and ensuring robust portfolio positioning for the digital age.